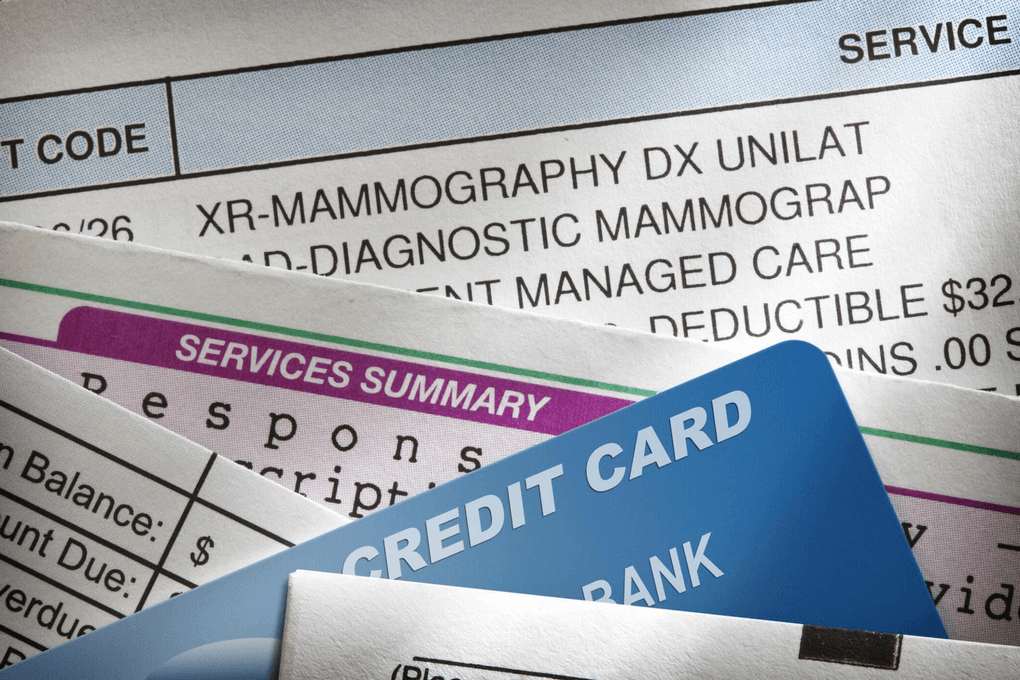

Have you ever wondered why you sometimes get a confusing bill after seeing a doctor or a procedure? Even if you have health insurance, you may owe money out of your pocket. This is known as medical debt, an increasingly common issue with wide-ranging ripple effects across families, communities, and the healthcare system.

Let’s break down key questions to make sense of this complex topic:

- What exactly is medical debt?

- How does it happen in the first place?

- Who does it impact?

- What effects does it have?

- What solutions and resources exist to address it?

As young adults entering the healthcare system, it’s essential to understand the often confusing world of medical billing and how to avoid drowning in debt just because you need medical care. Let’s explore. Let’s sack the medical bill: What is medical debt?

At its simplest, medical debt refers to money owed to a hospital, doctor’s office, or other medical provider after receiving their services. This happens when:

- You don’t have health insurance to help cover costs

- You have insurance but still owe money out of pocket (like a deductible, copay, or coinsurance)

- You inadvertently get care from a provider outside your insurance network

- Errors or discrepancies in billing lead to unexpected charges

The key players that come into contact around the medical debt cycle typically include:

- Patients.

- Healthcare providers (doctors, hospitals).

- Health insurance companies.

- Potentially third-party debt collection agencies.

Understanding exactly how medical billing and payment works sheds light on how debt can unexpectedly accumulate…

You visit a doctor or have a procedure > The provider bills your insurance company > Insurance pays part based on your plan details > You receive a bill for anything insurance didn’t> You get the bill within a specific timeframe > Any unpaid amount becomes a medical debt owed.

Is it straightforward enough? Unfortunately, given the complexity of insurance plans, billing procedures, and healthcare administration —errors and unintended charges easily sneak in. Suddenly, you owe $500 with no idea why!

This leads us to how medical debt sneaks up on so many Americans yearly…

From Ouch to Ouch: Reasons for Medical Debt

Even with insurance coverage, gaps exist in the US healthcare system that frequently trap patients with debt through minor faults of their own. Let’s look atLet’s prime offenders:

Lack of Insurance

Going completely uninsured puts you on the hook to pay healthcare providers “providers” and “out of pocket, which is almost always drastically inflated from what insured patients pay. A short hospital stay can lead to thousands of medical bills without coverage.

Surprise Billing

I thought you did your homework only to see in-network doctors covered by your insurance. You can still get smacked with surprise bills if other providers involved in treatment happen to be out-of-network, unbeknownst to you. For example, you plan for an in-network surgeon to conduct your procedure. But anesthesia services during the surgery get outsourced to an out-of-network provider who bills you separately!

High Cost of Care

The bottom line is healthcare costs have skyrocketed in the US, from doctor visit copays to prescription medications. Even insured patients need help to keep up with 5-10% yearly increases in deductibles, premiums, and out-of-pocket costs. Those with chronic health issues face perpetual medical debt despite having coverage.

Navigating the System

Frankly, the whole medical billing apparatus is a labyrinth. Endless streams of explanation of benefits statements, letters from insurance, bills from multiple providers, and more all add to the confusion. Errors like double-billing or misapplied health plan details can entrap patients with debt. Just understanding the terminology and red tape represents a steep learning curve.

While the deck seems stacked against patients, the ripple effects of this unpayable debt cast wider.

The Ripple Effect: Impact of Medical Debt

Left unpaid, medical debt delivers blows not just to personal finance but also to mental health, access to care, community welfare, and the healthcare ecosystem itself.

Financial Strain

Out-of-pocket medical costs constitute America’s #1 source of personal bankruptcy declarations. Even at less extreme levels, chipping away at medical debt drains income needed for housing, food, transportation, and other basic needs. Unpaid medical bills also sink credit scores, limiting access to financing for years.

Mental and Emotional Stress

For those already coping with illness or injury, mammoth medical bills bury patients under added layers of anxiety, depression, and uncertainty about the future. The constant stigma and pressure perpetuate suffering.

Access to Care

Fear of racking up debt deters many from seeking care early or consistently for both acute issues and chronic disease management. Avoiding “excessive” corporate visi” leads to worse health outcomes —at a more significant expense.

Societal Impact

With over $140 billion in medical debt outstanding, the burden on households, communities, and social safety net systems must be addressed. We all indirectly pay the price for an inefficient, lopsided system.

So what can be done to the course? Both societal and personal strategies show promise…

Navigating the Maze: Solutions and Resources

While major healthcare reform represents an apparent long-term policy need, individuals burdened today also have tools to mitigate risk. Here are best practices:

Understanding Insurance

First, decide what your health plan does and does not cover, including the out-of-pocket costs YOU are responsible for. Deductibles? Coinsurance rates? Copays? Out-of-network charges? Get intimately familiar, so surprises get minimized.

Negotiating Bills

If you receive a disproportionately large bill, don’t despair that hospitals and doctors often expect to haggle over charges! Call billing departments to contest errors, ask for discounts, or request manageable payment plans aligned with your budget. Many medical debts get resolved at discounted rates this way.

Exploring Financial Aid

Non-profit hospitals offer “charity care” assistance “funds for struggling patients who meet income criteria. The National Association of Free & Charitable Clinics website helps patients find affordable or accessible clinics in their local area to access medical services.

Pharmaceutical companies sponsor payment assistance plans to help cover costly medications for those in need. The Pharmaceutical Research and Manufacturers of America (PhRMA) website offers a searchable database of hundreds of national and state-based patient assistance programs that provide free or discounted prescription drugs.

Government health insurance programs also serve as a vital safety net, with Medicaid providing coverage options for qualifying low-income uninsured individuals. The official Healthcare.gov website outlines Medicaid eligibility, enrollment details state-by-state, and how to apply.

Seeking Help

Various national and local non-profits give guidance in navigating medical payment headaches, from bill reviews to debt management advice. Discover available allies ready to advocate on your behalf!

While arduous, the effort invested in comprehending the medical billing circus can help avoid drowning in unnecessary debt and associated stress.

So Exactly What is Medical Debt?

As we’ve explored, debt constitutes bills owed for healthcare services, often unexpectedly, due to insurance gaps and a convoluted billing system. The financial and emotional tolls affect individual health and societal welfare. But by understanding the mechanisms behind the medical debt machine, we can adapt – arming ourselves with information, resources, advocacy groups, and negotiation strategies. The power to change course rests on both a personal and policy level.

Hopefully, this breakdown has illuminated the medical debt dilemma and equipped you to make intelligent financial decisions, access available support, and rally for meaningful improvements that put patients over profits. The time for progress is now!

Disclaimers: This article offers general info on medical debt, but it’s unsuitable for professional medical or financial advice. While based on reliable sources, individual circumstances vary. Consult a healthcare professional for medical concerns and a financial advisor for personalized financial guidance. Research and utilize reputable resources for further information and support. Remember, seeking professional advice empowers informed decisions regarding your health and finances.

Why, even with insurance, do I still have a medical bill?

Even with insurance, you might face medical debt due to deductibles, copays, coinsurance, out-of-network charges, and billing errors. Understanding your coverage details and scrutinizing bills for mistakes are key.

What are the main culprits behind medical debt?

Lack of insurance can leave you with the total, inflated cost of care. Surprise billing from out-of-network providers, rising healthcare costs, and the confusing billing system can contribute to debt, even for insured individuals.

How does medical debt impact me?

Medical debt can create financial strain, causing anxiety, depression, and hindering access to future care. It can also damage your credit score, impacting your ability to secure loans or other financial opportunities.

What can I do to manage medical debt?

Understanding your insurance and negotiating bills for errors or discounts are crucial. Exploring financial aid options from hospitals, drug companies, and government programs can help. Additionally, non-profit organizations offer guidance and support in navigating medical debt.

How can we tackle medical debt on a larger scale?

Advocating for policy changes that reduce healthcare costs, expand coverage, and protect patients from surprise billing is essential. Educating others about medical debt and empowering individuals to manage their finances can create positive change. Supporting advocacy groups fighting for equitable and affordable healthcare can drive meaningful progress in tackling this widespread issue.