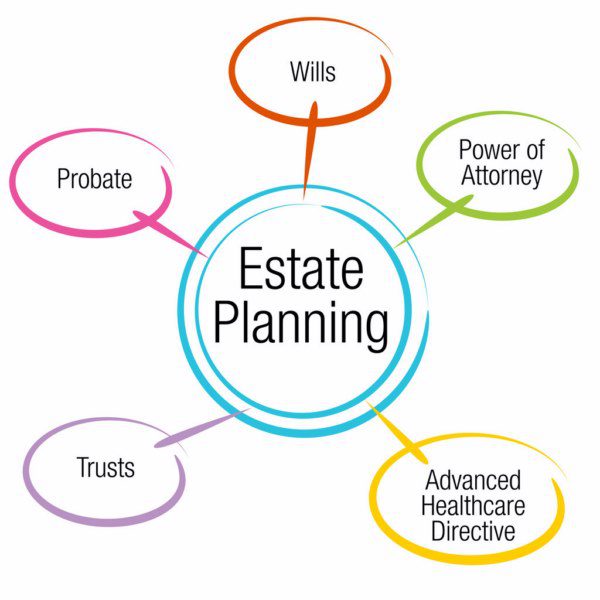

Estate planning -The term likely conjures thoughts of affluent, older people sitting around a heavy wooden table discussing trusts, wills, and dividends. But estate planning is far more expansive and, frankly, more interesting than just old money and woody board rooms.

Estate planning impacts anyone who wants a say in where their possessions and assets go after they pass away. Whether you have an antique piano or a simple savings account, estate planning gives you control over what happens once you’re gone. It can provide immense peace of mind knowing your loved ones and causes you care about will be provided for into the future.

I know first-hand from the challenges my parents faced. Without clear instructions, we squabbled over minor trinkets and who should handle finances. Don’t assume your family will smoothly work it out! Things can get complicated surprisingly fast…

So read on to truly understand all that estate planning entails! I was struck by how much more it involves than I initially realized. But taking the time now saves your loved ones headaches down the road.

Accounting for What You Have

The first step in creating your personal estate plan involves taking inventory of what assets you currently have. This accounting exercise may end up encompassing more than you think! Intangible digital possessions can get overlooked.

For starters, itemize major categories:

- Real estate properties like your home, rental properties, vacation cottages

- Vehicles such as cars, boats, recreational vehicles

- Bank accounts, including checking/savings accounts and Certificates of Deposit

- Investment accounts like retirement plans (401ks, IRAs), brokerage accounts, annuities

- Life insurance policies with cash value accumulation

- Business partnerships and privately-owned companies

- Valuables like jewelry, art, coin/stamp collections, antiquities

Don’t forget small personal effects that may have sentimental attachment for intended heirs, like musical instruments, books, handcrafted furniture from a relative, or your coin baseball card collection from childhood.

Also, catalog debts you owe, such as mortgages, vehicle financing, student loans, medical bills, and credit card balances. This full financial portrait will clarify what requires repayment first and forewarn your survivors so they aren’t blindsided.

Assemble documentation around assets, deeds, titles, account statements, and policy documents. Details, like named beneficiaries and joint ownership with rights of survivorship, become very important for distributing certain assets directly without probate delays.

If this all sounds tedious, I agree! But please take my word that your future executors will thank you profusely for organizing things ahead of time.

What assets should I list for thorough estate planning?

Catalog major assets like real estate, vehicles, retirement/investment accounts, insurance policies, valuables collections, and personal possessions. Additionally, document debts owed and account/policy documentation details like named successor holders. Even documenting digital login credentials helps executors access valuable online assets through the inheritance process.

Handling Digital Assets

In our internet-connected age, you may own valuable digital assets that are not obvious at first glance:

- Email accounts

- Social media profiles

- Photo and video storage

- Domain names and websites

- Materials with copyrights

- Online financial accounts

- Stored business data

Logging into email alone often facilitates resetting passwords and accessing other online accounts for managing someone’s affairs after death. List login credentials safely for digital assets and clarify your preferences for maintaining certain accounts as online memorials versus deactivating.

Wills and Trusts: Your Instructions and Plan

Now comes the fun part – deciding how to pass different assets along to your chosen beneficiaries! This section covers critical tools for spelling legally binding instructions on inheritance wishes and trustee oversight.

Last Will

A last will constitute the basic building block, stating beneficiaries explicitly in your own words. Anyone over 18 with legal “capacity” (sound mental ability) can craft a will. This document handles the distribution of individually owned assets not otherwise bound by contractual rules around survivorship rights or named beneficiaries.

Wills don’t avoid probate, however. This court-supervised process confirms the will’s validity, officially appoints your designated executor, calculates any estate taxes owed, and ultimately authorizes asset transfer to beneficiaries. Probate can eat up 4-5% in attorney fees and executor commissions for larger estates. It also may delay distributions up to 1-2 years in some states due to bureaucratic courts and red tape.

Revocable Living Trusts

For more control and privacy, establish a revocable living trust to hold assets during life and distribute them to heirs upon death. A trust is governed by a legal entity managed by a trustee per the guidance in the trust document. As the name implies, you can modify a revocable trust at any time while alive.

A living trust transfers assets seamlessly without probate upon the original owner’s passing. Think of it as a substitute mechanism parallel to and separate from standard probate proceedings. It becomes irrevocable only at death.

Living trusts allow for nuanced instructions compared to short-and-simple will bequests:

- Assets can stay in ongoing trust rather than thoroughly distributed, allowing structured payments over time (outstanding for reckless heirs!)

- Divide assets into separate incremental trusts for each beneficiary.

- Build in investment oversight and restrictions within the trust itself.

Trusts also prevail over wills in jurisdiction disputes since they transfer “situs” (legal residency) upon creation to the state where they were established.

Wills and living trusts work very nicely together as complementary components. Use the “pour-over will” as a backup to catch any stray assets not titled in the name of your trust while alive. This dumps them into the existing trust structure upon death. It’s the best of both worlds!

If Something Happens Before You Pass

Beyond deciding asset distribution at your death, estate planning also tackles the sobering possibility of losing decision-making capacity while still living, whether from dementia, brain injuries, or other severe health events. Having contingency plans prevents court guardianship disputes between well-meaning but differently-opinionated family members.

Durable Financial Power of Attorney

The durable financial power of attorney grants someone you select authority to conduct financial transactions in your stead if you become incapacitated. This avoids ugly court guardianships determining control of your affairs. The “durable” component means this special POA remains enforceable even after you lose competence (unlike standard POAs that expire).

Carefully consider who could handle that responsibility sensitively yet objectively. While your spouse may seem the obvious answer, the emotional turmoil of seeing a partner decline could cloud rational decisions. Adult children work sometimes but think hard about head-butting among siblings. Or tap a close friend without direct inheritance conflicts.

Advance Health Directives

Suppose you suffer a grievous health episode, leaving you unable to convey treatment preferences or life support wishes. How does the medical staff or next of kin know what you want? Enter advance health directives like living wills and medical POAs.

A living will outline specific care instructions, life-prolonging measures to avoid, and comfort-focused directives. Studying example living will templates helps imagine different health tragedies and clarify wishes around things like CPR, breathing tubes, feeding tubes, dialysis, pain medicine, and organ donation.

For rapidly evolving emergency decisions, designate someone through medical power of attorney to interact with doctors as your advocate. Choose very carefully, considering who could emotionally handle end-of-life conversations on your behalf.

Preparing the unthinkable through living will and medical POA discussions equips caregivers and health providers to save your loved ones excruciating guessing around your care preferences if unable to speak for yourself.

Getting Your House in Order

Once you pass away, the executor appointed in your will (or designated in trust documents) oversees your estate settlement. This requires cleanly closing financial accounts, paying any lingering debts not extinguished at death, and gathering/valuing all assets under their stewardship.

Probate and Estate Settlement

Without a living trust, the will enters probate courts to assess validity and formally name the executor. The executor must notify all creditors of your death, paying rightful debts first while denying unjust claims. They also calculate estate taxes with filings due within nine months absent tax extension approvals.

Meanwhile, your executor spends extensive effort tracking down assets, obtaining appraisals for significant valuables concentrated in your estate, and keeping meticulous financial records. The probate judge expects a full estate inventory and may randomly audit submissions for truthfulness. Depending on state laws, this troublesome settlement process drags 1-2 years in larger estates!

Can I change my will, trust, or other estate plan components later if things change?

Yes, estate planning should evolve across your lifetime as family dynamics and your financial portrait change shape. Revocable trusts and basic will undergo simple modification procedures, including amending documents or writing new versions. Alter beneficiary selections on accounts/policies directly with account administrators when needed. Revisit things every few years!

Paying Creditors & Final Tax Filings

Your estate fiduciarily prioritizes paying legitimate creditor claims before shelling out inheritance bequests. How aggressively creditors seek payment depends partly on state statutes of limitations; most fall in the 1-3 year range.

One final burden for your executor is submitting outstanding tax returns and filing any liability payments owed from your final year of life. So they’ll be thoroughly reconciling income thresholds related to distributions received after death and wrapping up deductions available in the year of passing. What a nice parting gift from you, right?

Getting Your House in Order

Once you pass away, the executor appointed in your will (or designated in trust documents) oversees your estate settlement. This requires cleanly closing financial accounts, paying any lingering debts not extinguished at death, and gathering/valuing all assets under their stewardship.

Probate and Estate Settlement

Without a living trust, the will enters probate courts to assess validity and formally name the executor. The executor must notify all creditors of your death, paying rightful debts first while denying unjust claims. They also calculate estate taxes with filings due within nine months absent tax extension approvals.

Meanwhile, your executor spends extensive effort tracking down assets, obtaining appraisals for significant valuables concentrated in your estate, and keeping meticulous financial records. The probate judge expects a full estate inventory and may randomly audit submissions for truthfulness. Depending on state laws, this troublesome settlement process drags 1-2 years in larger estates!

Paying Creditors & Final Tax Filings

Your estate fiduciarily prioritizes paying legitimate creditor claims before shelling out inheritance bequests. How aggressively creditors seek payment depends partly on state statutes of limitations; most fall in the 1-3 year range.

One final burden for your executor is submitting outstanding tax returns and filing any liability payments owed from your final year of life. So they’ll be thoroughly reconciling income thresholds related to distributions received after death and wrapping up deductions available in the year of passing. What a nice parting gift from you, right?

What documents should everyone have in place for estate planning?

At a minimum, create a will, durable power of attorney for finances, advance medical directives like a living will, and medical power of attorney. These four ensure your legacy wishes are honored, you have representation if incapacitated, and health care preferences guide end-of-life decisions. Protect loved ones by taking the time to complete this essential estate planning paperwork.

Lowering Your Estate’s Taxes

Even after doing everything correctly to prepare one’s estate, a major gut punch remains through income and estate taxes taking a further bite from assets you wish passed intact for heirs to enjoy. While eliminating tax liability proves nearly impossible (short of questionable offshore scheming!), prudent planning can substantially reduce depletion, specifically when starting early in life before assets mushroom.

Annual and Lifetime Gift Allowances

One easy tactic utilizes the current annual gift tax exclusion, permitting you to transfer up to $16,000 each year to as many recipients as you like without eating into your lifetime estate, and the gift tax exemption currently stands at over $12 million. Even moderately consistent annual gifting against this exclusion over several decades compounds advantages, eventually transferring seven-figure sums without tax impacts.

For context, lifetime exemption caps shelter over $12 million in assets (including gifts over the annual ceiling). So, yearly gifts up to $16k pass tax-free without counting against that larger limit and reduce your taxable estate incrementally over time.

Trust Strategies

Specialized trusts build additional shields with rules limiting beneficiaries’ control over assets for a period of time. This keeps their distribution shares protected if faced with divorce, creditors, or premature death.

A/B marital trust structures retain more wealth within family lines across multiple generations. The surviving married partner accesses their share (Trust A) while the deceased’s portion (Trust B) transfers tax-favorably to children. Charitable remainder trusts pay annual income to individual beneficiaries for life while the remaining assets ultimately route to charity.

Philanthropy

Charitable giving performs double duty by directing funds to causes important to you while reducing taxable estate value.

Lifetime gifting amplifies benefits compared to testamentary bequests within your will or trust upon passing. Many community foundations and donor-advised fund sponsors like Fidelity Charitable or Schwab Charitable enable establishing named funds where you retain advisory privileges to distribute grants to IRS-qualified public charities over time.

Who should I select to oversee executing my estate plan through powers of attorney?

Carefully name agent successors you deeply trust for sensitivity and judgment in managing healthcare, financial, or estate settlement decisions if unable to do so yourself. While relatives top most lists, consider risks posed by family feuds, emotional trauma, or financial conflicts of interest in powers over you. Trusted close friends or fiduciary advisors provide alternative options.

Final Thoughts about Estate Planning

If your head spins contemplating layers of complexity around estate planning, I fully get it. I certainly felt overwhelmed at first, wondering whether I needed pricey attorneys just for basic contingency preparations. But taking things step-by-step, estate planning becomes very manageable and, importantly, grants peace of mind, knowing you’ve done your family right with organized documentation of your assets and legacy wishes.

While I focused considerable discussion on tax minimization and savvy wealth transfer suggestions, even modest estates benefit enormously just from essential documents like wills, advance directives, and basic beneficiary selections to guide inheritance allocation. At a minimum, complete that fundamental blocking and tackling!

Then, for larger or highly complex asset portfolios, including private businesses, intensive retirement accounts, or extensive real estate holdings, investigate specialized trusts and strategic tax mitigation transfers. The high dollar results justify consulting certified financial planners and estate attorneys.

Frankly, estate planning never fully wraps up with a nice, tidy bow. Revisit the legal preparations at life milestones like major moves, inheriting substantial assets yourself, or marriage/divorce/births shaking up your priorities for wealth distribution down the road. What you arrange today could transform in 5, 10, or 20+ years, so keep bindings loose for evolving circumstances.

Maybe I’m strange, but after investigating specifics extensively to create my plan, I found the morbid planning weirdly rewarding, even liberating! Visualizing contingencies like declining health or premature passing consciously makes me doubly determined to live intentionally and prevent future regrets. Other side benefits manifested, too – I consolidated disjointed investment accounts, identified insurance gaps, and prioritized the relationships that mattered most for long-term giving.

While ruminating over legal particulars won’t excite everyone, I hope illuminating fuller context around estate planning here recalibrates your perspective too. Substantial opportunities exist both to care for your survivors in the future as well as reframe the present based on clarifying your legacy aims today. Please invest in yourself through some estate planning attention! Your people will thank you, as will your peace of mind around life’s only certain ending.

How expensive is professional help for creating an estate plan?

Estate planning lawyers typically charge $200-$500 per hour but may quote flat project fees from as low as $1,000 for basic wills up to $5,000+ for intricate trusts and tax work. Financial planners usually offer hourly rates around $150-$300 or overall plan packages from $1,200-$3,000. Costs vary substantially based on plan complexity and local rates. Most find the peace of mind cost-justifies professional assistance.